Note: The information below can be used if filing taxes in 2022 for a solar installation that was placed into service in 2021. In August 2022, congress passed the Inflation Reduction Act, reauthorizing the solar tax credit at 30% through 2032. A new version of this article will be published before tax time in 2023.

It’s that time of year again—tax time! But this year is different, because this was the year you installed solar panels on your home (or qualifying property), and now you’re ready to get that tax credit to get 30% of that expense back from the government. And we’re here to help guide you through the process!

We’ve included an example below of how to fill out the tax forms. We’ve also included a section at the bottom of this post that answers some frequently asked questions about the process of claiming the credit.

KEEP IN MIND: We are solar people, not tax people. We do not give tax advice, and anything you read on this page is merely one example of how someone might act. Please consult a tax professional before filing.

Let’s get started !!

What you need to claim the tax credit

- The receipts from your solar installation

- IRS Form 1040 for 2021

- IRS Form 5695 for 2021

- Instructions for both those forms (also available from the links above)

- A pencil & A calculator

Fill out your Form 1040 as you normally would. When you get down to line 20, Stop and move to Schedule 3, which uses your calculations from Form 5695 on line 5.

How to fill out Form 5695

Today, we’re helping “Example Exampleson,” who hails from my home state of Minnesota.. He spent $15,500 to install a 6.2 kW solar panel system on his home, and entered that number in line 1 below:

So what’s a qualified solar electric property cost? Here’s what the instructions for Form 5695 say:

“Include any labor costs properly allocable to the onsite preparation, assembly, or original installation of the residential energy efficient property and for piping or wiring to interconnect such property to the home.

Qualified solar electric property costs are costs for property that uses solar energy to generate electricity for use in your home located in the United States. No costs relating to a solar panel or other property installed as a roof (or portion thereof) will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed. Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit. This is in contrast to structural components such as a roof’s decking or rafters that serve only a roofing or structural function and thus do not qualify for the credit.

Pretty much any cost related to installation and materials of solar energy generating property counts.

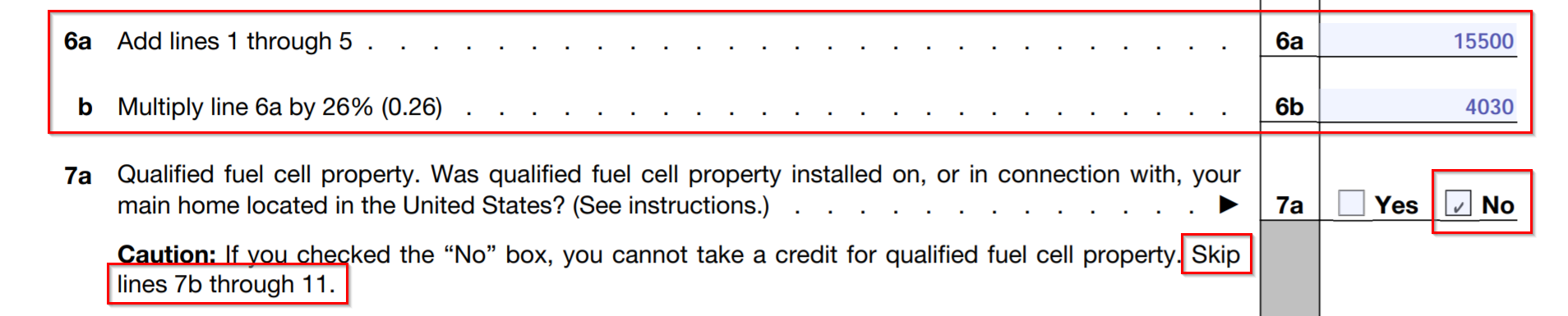

Next, unless you also installed solar water heating equipment or a geothermal heat pump, move on to line 6. Follow the instructions on the form to complete lines 6 and 7:

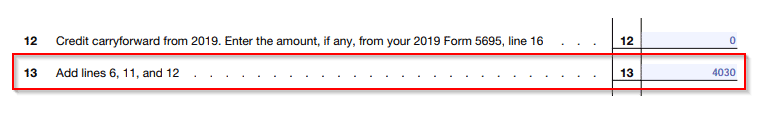

Skip to line 12 unless you installed fuel cell property (huh?), and enter in any credit you’re carrying over from a qualified energy property installation (like a previous solar installation) from the previous year. Then fill in line 13 with the total amount of credit from lines 6, 11, and 12. In Mr. Exampleson’s case, he has no prior-year credit to add, so he just puts the same $4,030 from line 6:

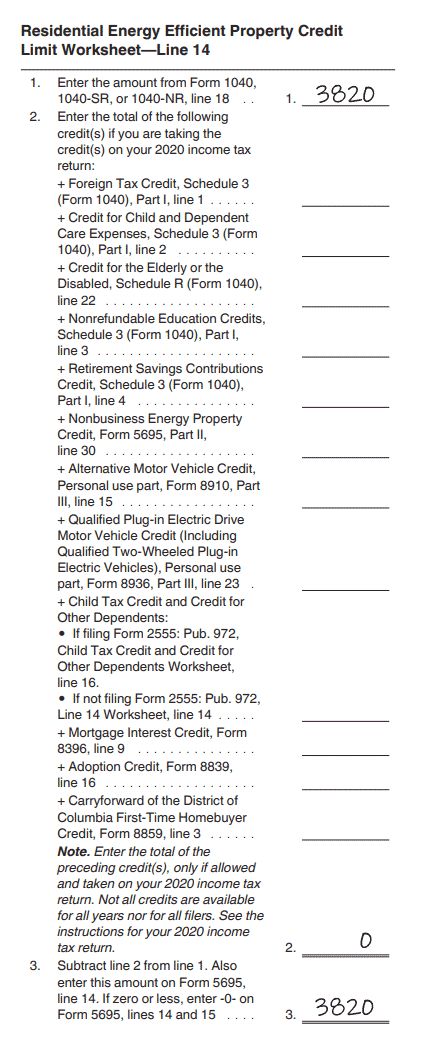

Form 5695 Line 14 Worksheet – Reducing the credit

Line 14 is where it gets tricky. The thing about the solar tax credit is it isn’t “fully refundable,” meaning you can only take a credit for what you would have owed in taxes. This is different from other, fully refundable tax credits like the Child Tax Credit and the Health Coverage Tax Credit.

That’s why you use the worksheet below. You enter the total tax you owe before credits in line 1 of the worksheet, and the amounts of any fully refundable credits on the lines within step 2, adding them all on the final line.

Then, subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3. This is the total amount you can claim for the solar tax credit.

Here’s what the line 14 worksheet looks like for Mr. Exampleson, who has an initial tax liability (listed on line 1 below) of $3,820 this year, and can claim no other tax credits:

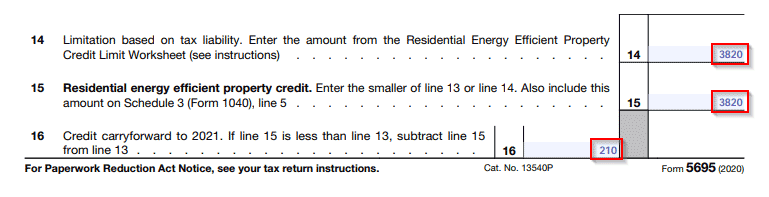

Because Mr. Exampleson only owes $3,820 in taxes this year, that’s all the credit he can take now. He enters that number on lines 14 and 15 of Form 5695, and then enters $210, which is the difference between his total credit ($4,030) and the credit he can take this year ($3,820), onto line 16.

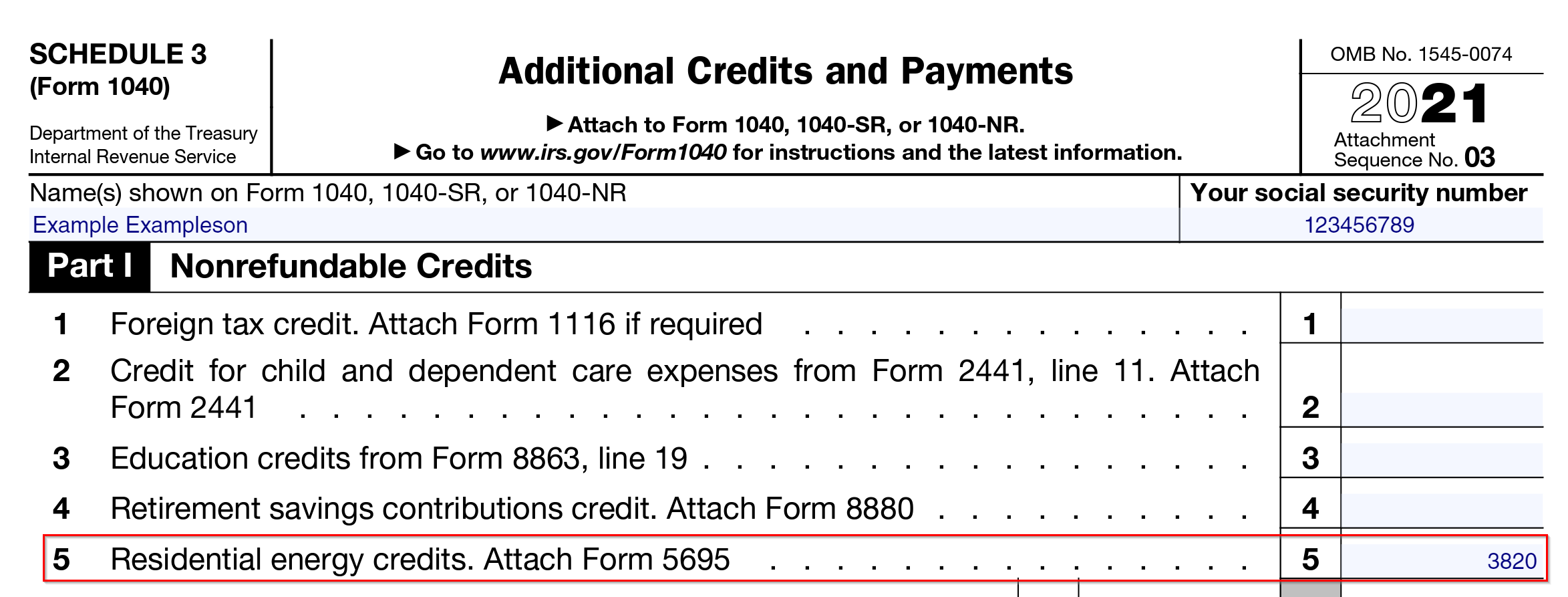

Finally, he enters the amount from line 15 on Form 5695 into the box on line 5 of Schedule 3.

That’s it! Mr Exampleson owes $0 taxes this year, and will get a further credit of $210 on his 2022 tax return. He may also qualify for refundable tax credits on the second part of Schedule 3.

Now, check out the tax credit FAQ below.

Frequent Form 5695 questions and considerations

Q: I got a rebate from my utility company for my solar panels. Do I calculate the 26% tax credit before or after the reduction from the rebate?

A: We get this question all the time, and here’s the best answer: You calculate the 26% federal tax credit based on the cost to you AFTER any rebates.

For example, if your system cost $20,000 and you received a $5,000 rebate from the utility, your federal tax credit would be 26% of $15,000, which is $3,900. Here’s the tricky part: if your state ALSO gives you a tax credit, you don’t need to worry about that amount to calculate your federal credit.

Both state and federal tax credits are calculated based on the amount you paid, minus rebates or grants.

Q: If I installed a solar panel system a few years ago and now I want to add new panels, can I claim the credit?

A: Yes! You can claim the credit for any new costs associated with the addition. You can’t go back and claim the credit for the previously-installed equipment. Hopefully you already claimed the credit for those costs back then.

Q: If I install solar and claim the tax credit, will I have to repay the credit to the government if I sell my house within a certain number of years?

A: No! If you install a solar panel system on a home you own, you can claim the whole credit and sell at any point after.

The converse is also true; If you are buying a house with solar panels—even if they were just installed by the previous owner—you’re not eligible for any portion of the tax credit. Keep in mind this is only true for home installations. The law is significantly more complex for commercial solar installations.

Q: Can I get a tax credit if I installed solar panels on a rental property I own?

A: If the property is a rental only, you cannot claim the tax credit. However, if you own the property and maintain it as a residence for a certain portion of the year (i.e., you rent it out while you’re away), you can claim the credit for the portion of the year you spend there.

For example, if you installed $20,000 worth of solar panels on a home in Florida that you live in from November 1st to May 1st, and you rent that home during the summer, you are entitled to take 50% of the possible tax credit, or $2,600 (26% of $20,000 is $5,200, and 50% of that is $2,600).

Q: I just received a quote from a solar company. They informed me that I needed a new roof to hold the solar array. Can I get the tax credit based on the cost of both the roof and the solar, as it was an additional cost?

A: Let’s be clear again that we’re not tax experts, but it looks pretty clear that the answer is no. Early in this article, we quoted the instructions for Form 5695. Here it is again:

“No costs relating to a solar panel or other property installed as a roof (or portion thereof) will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed.

Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit. This is in contrast to structural components such as a roof’s decking or rafters that serve only a roofing or structural function and thus do not qualify for the credit.”

It’s pretty clear that what they’re saying here is “costs for anything that is necessary to have a regular roof cannot qualify as solar costs.” If only they said it that plainly.

Q: Should I claim the tax credit if I partially paid (i.e., a deposit) in 2021 for an installation that won’t be completed until 2022?

A: No. The instructions for Form 5695 say “Costs are treated as being paid when the original installation of the item is completed,” so you can claim all the costs for your installation no matter when they were paid, but you have to wait to claim them in the year the installation takes place. Keep receipts!